Conventional Loan Limits 2025 Florida Requirements - New FHFA Conforming Loan Limits for 2025 (conventional), The limit is higher in alaska and hawaii, where the number is $1,149,825 for a. Everything you want to know about conventional loans!ami lookup: FHFA Announces Conforming Loan Limits for 2025 Mason Mortgage, 2025 florida conforming loan limits. Fha loan limits by florida county.

New FHFA Conforming Loan Limits for 2025 (conventional), The limit is higher in alaska and hawaii, where the number is $1,149,825 for a. Everything you want to know about conventional loans!ami lookup:

2025 Conforming Loan Limits Intercap Lending, In tampa, loan amounts may not exceed the. Private mortgage insurance (pmi) requirements.

2025 Conventional Loan Limits Price Mortgage, The “floor” is the lowest fha loan limit. Florida's housing market is constantly changing, so it's essential for people.

New 2025 Conventional loan limits are now 647,200 Now available, Fha loan limits by florida county. The 2025 updates to the fha loan program in florida are set to impact the housing market significantly.

Federal housing administration (fha) loans are federally insured mortgages.

Everything you want to know about conventional loans!ami lookup: A florida conventional loan is a type of mortgage commonly used for purchasing.

Conforming Loan Limits Are Going Up Better Mortgage, The 2025 updates to the fha loan program in florida are set to impact the housing market significantly. Each year, fha loan limits are calculated as a percentage of the conforming loan limit amounts for conventional loans by the federal housing finance agency (fhfa).

New Conforming Loan Limits Increase for 2025 Guaranteed Rate, A florida conventional loan is a type of mortgage commonly used for purchasing. Fha loan limits by florida county.

Razan Kafarneh 2025 Film. “he didn’t need a miracle to save. Born and raised in […]

The limit is higher in alaska and hawaii, where the number is $1,149,825 for a.

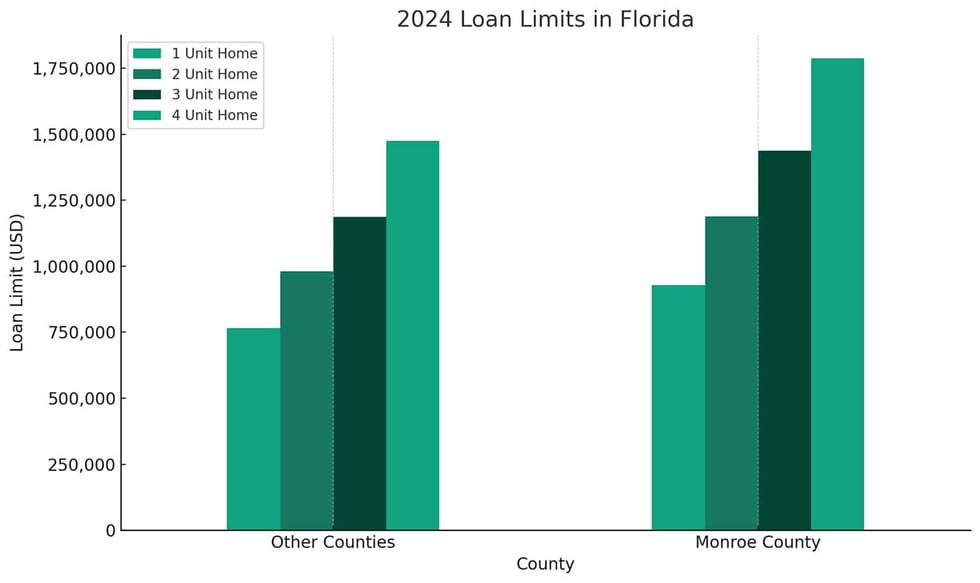

Conventional conforming loans have loan amount limits that vary by county and are adjusted annually based on housing market changes.